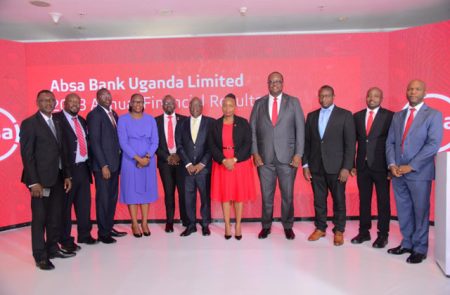

• Growth in revenue by Sh64bn • Sh146 billion in profit after tax • 12.9% growth in net customer loans standing at Sh1.76 trillion…

KAMPALA, (Examiner) – The Monetary Policy Committee (MPC) of the…

President Yoweri Kaguta Museveni has launched Salaam Bank, Uganda’s first…