By Naome Namusoke/KMA Updates

Kampala, Uganda — Statewide Insurance Company (SWICO) has launched Dog Insurance, the first-ever product of its kind in Uganda, reaffirming its commitment to innovation and customer-focused service delivery. The launch took place during a CEO Breakfast Meeting organized by the Insurance Brokers Association of Uganda (IBAU) under the theme “Driving Transformation Together.”

The new Dog Insurance policy is designed to protect pet owners against the financial costs associated with veterinary care, accidents, injuries, theft, or loss of their dogs. The product also extends to third-party liability, reflecting a growing recognition of pets as integral members of households and a shift toward diversified insurance coverage in Uganda.

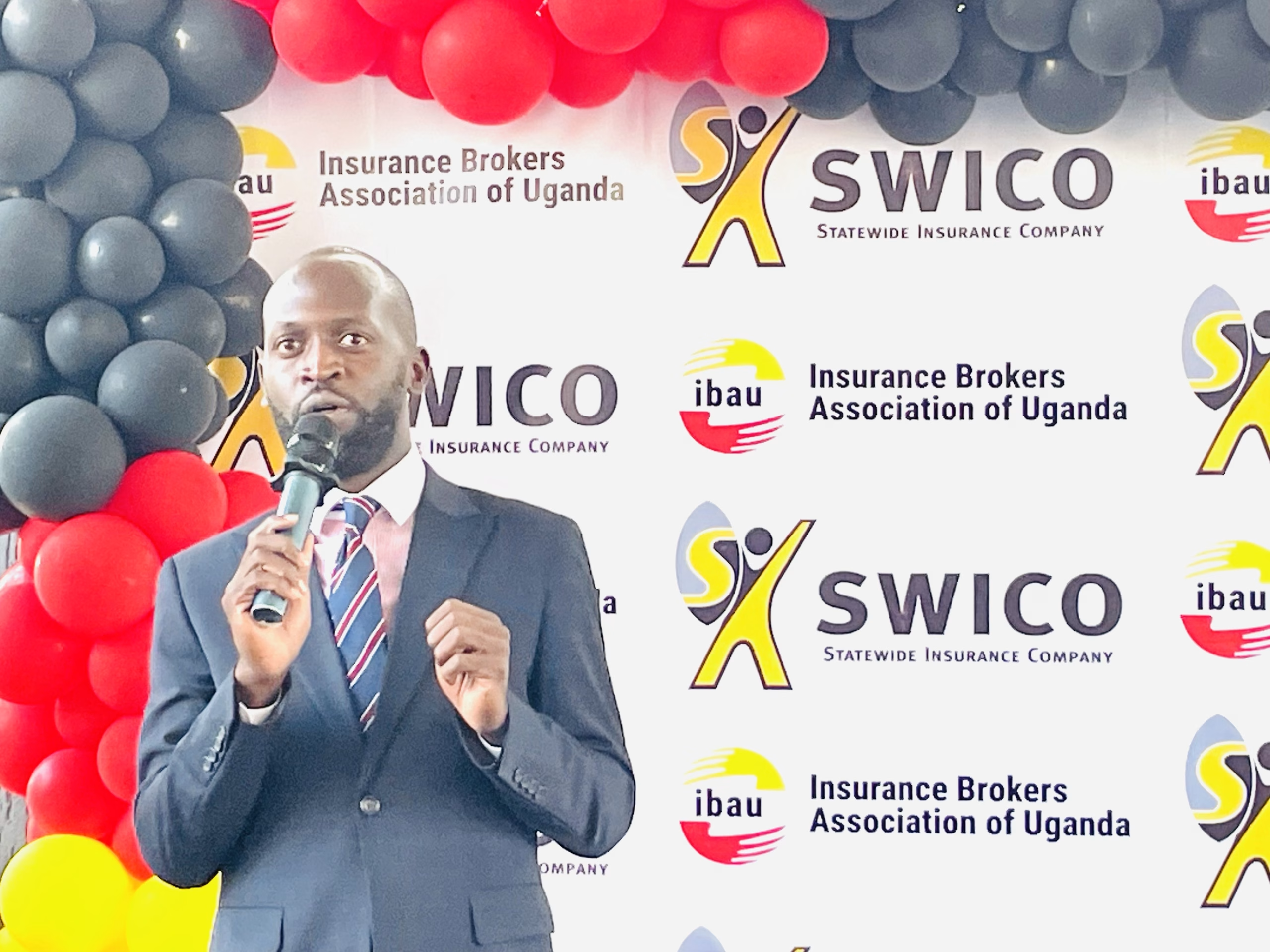

Speaking at the launch, Hamza Mutebi, the Chief Executive Officer of SWICO, said the introduction of the product underscores the company’s vision of developing customer-centered innovations that respond to emerging lifestyle changes and evolving risks.

“As the needs of our customers change, our responsibility as insurers is to evolve with them. Dog Insurance is a reflection of how we can innovate around the real priorities of Ugandans ensuring that protection goes beyond traditional assets like cars and homes,” Mutebi said.

Mutebi further emphasized that SWICO is investing in research-driven product development to ensure that new offerings not only address existing market gaps but also strengthen customer confidence in the insurance sector.

According to the Insurance Regulatory Authority of Uganda (IRA), the country’s insurance penetration rate currently stands at less than 1% of GDP, compared to the global average of around 7%. The industry’s gross written premiumsgrew to UGX 1.7 trillion in 2024, marking a 13% increase from 2023 a positive trajectory that experts say can be sustained through innovation and improved consumer education.

Prof.Samuel Sejjaka

Delivering a keynote address, Professor Samuel Sejjaaka, Country Business Leader at MAT ABACUS Business School, challenged insurance companies to rethink their business models for sustainable growth.

“Insurance companies don’t grow because they tend to have a short-term view of things. There’s also a serious trust deficit between insurers and the public, and that’s a bigger problem that must be addressed,” he said.

Prof. Sejjaaka added that for the insurance industry to thrive, companies must invest in building long-term relationshipswith customers, backed by transparency and consistency.

He also underscored the persistent challenge of financial illiteracy among Ugandans, which continues to hinder insurance uptake.

“Many Ugandans don’t fully understand how insurance works or its benefits. This gap in knowledge limits participation and affects sector growth. Financial literacy must therefore become a national priority,” Sejjaaka stressed.

The Insurance Brokers Association of Uganda, which hosted the CEO Breakfast, noted that such engagements are crucial in driving dialogue and collaboration among industry leaders. The association aims to foster a customer-first culture, product innovation, and trust-building within the insurance ecosystem.

The introduction of Dog Insurance positions SWICO as a trailblazer in Uganda’s insurance innovation space, signaling a future where insurance is not just a financial requirement but a lifestyle necessity tailored to modern realities.

As the company continues to “drive transformation together,” industry stakeholders see the move as a strategic step toward building a more inclusive, trusted, and resilient insurance market in Uganda.